List of Electric Vehicles Qualify for US Federal Tax Credits 2023

Check the new US federal tax credits details if you plan for an electric or plug-in hybrid in 2023. The Treasury Department has announced the list of new plug-in hybrid and electric cars that will qualify for federal tax credits of up to $7,500. The electric cars list is expected to be updated in the coming days.

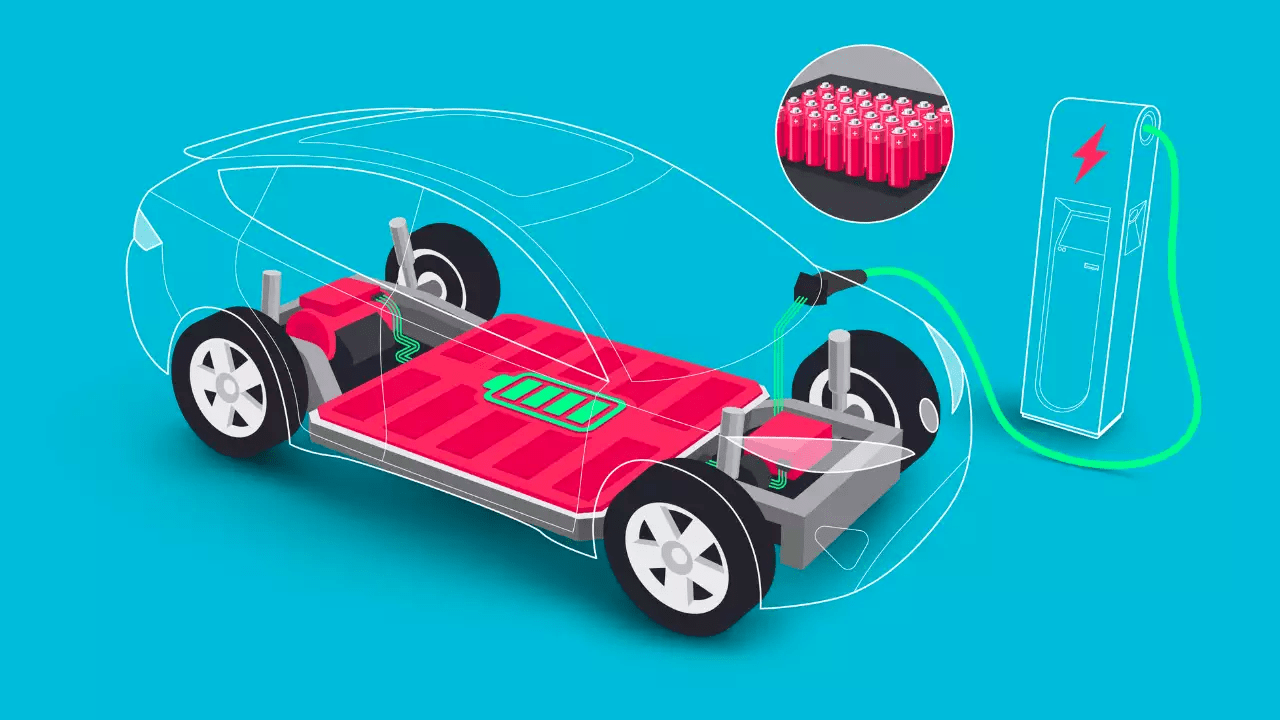

According to the US Department of Energy, you can't buy an electric car. The amount you qualify for depends on the income tax and the size of the electric battery inside the vehicle you purchase. Now we must consider IRA (Inflation Reduction Act) before owning an electric car in North America.

The credits will apply to sedans that cost not more than $55,000 and sport utility vehicles, and pickup trucks which cost $88,000. And buyers who earn less than $150,000 a year as an individual or $3,00,000 a year as a couple, or $225,000 a year for heads of households can claim the credits.

Do Know

- US Postal Service Hopes Electric Delivery Vehicles by 2026

- Rimac Nevera World's Fastest Electric Car in 2023

Eligibility for Electric Vehicles to Qualify Tax Credits

To qualify for the US federal tax credits, a vehicle must have the following requirements.

- The battery capacity of a vehicle should be at least 7kw hours.

- The gross vehicle weight rating should be lesser than 14,000 pounds.

- EVs should be manufactured by a qualified manufacturer.

Which Electric Vehicles qualify for Federal Tax Credits?

The following is the list of electric and plug-in hybrid vehicles that qualify for federal tax credits in 2023.

Audi

- Q5 TFSI e Quattro plug-in hybrid

General Motors

- Chevrolet Bolt and Bolt EUV

- Cadillac Lyriq

BMW

- 330e plug-in hybrid

- X5 xDrive45e plug-in hybrid

Nissan

- Leaf

Ford Motor

- Ford Escape Plug-in Hybrid

- Ford E-Transit

- Ford F-150 Lightning

- Ford Mustang Mach-E

- Lincoln Aviator Grand Touring plug-in hybrid

- Lincoln Corsair Grand Touring plug-in hybrid

Rivian

- R1T

- R1S

Stellantis

- Chrysler Pacifica plug-in hybrid

- Jeep Wrangler 4xe plug-in hybrid

- Jeep Grand Cherokee 4xe plug-in hybrid

Volkswagen

- ID.4

Tesla

- Model 3

- Model Y

Volvo

- S60 plug-in hybrid

To claim the credit file Form 8936, Qualified Plug-in Electric Driver Motor Vehicle Credit with your tax return and your vehicle's VIN.